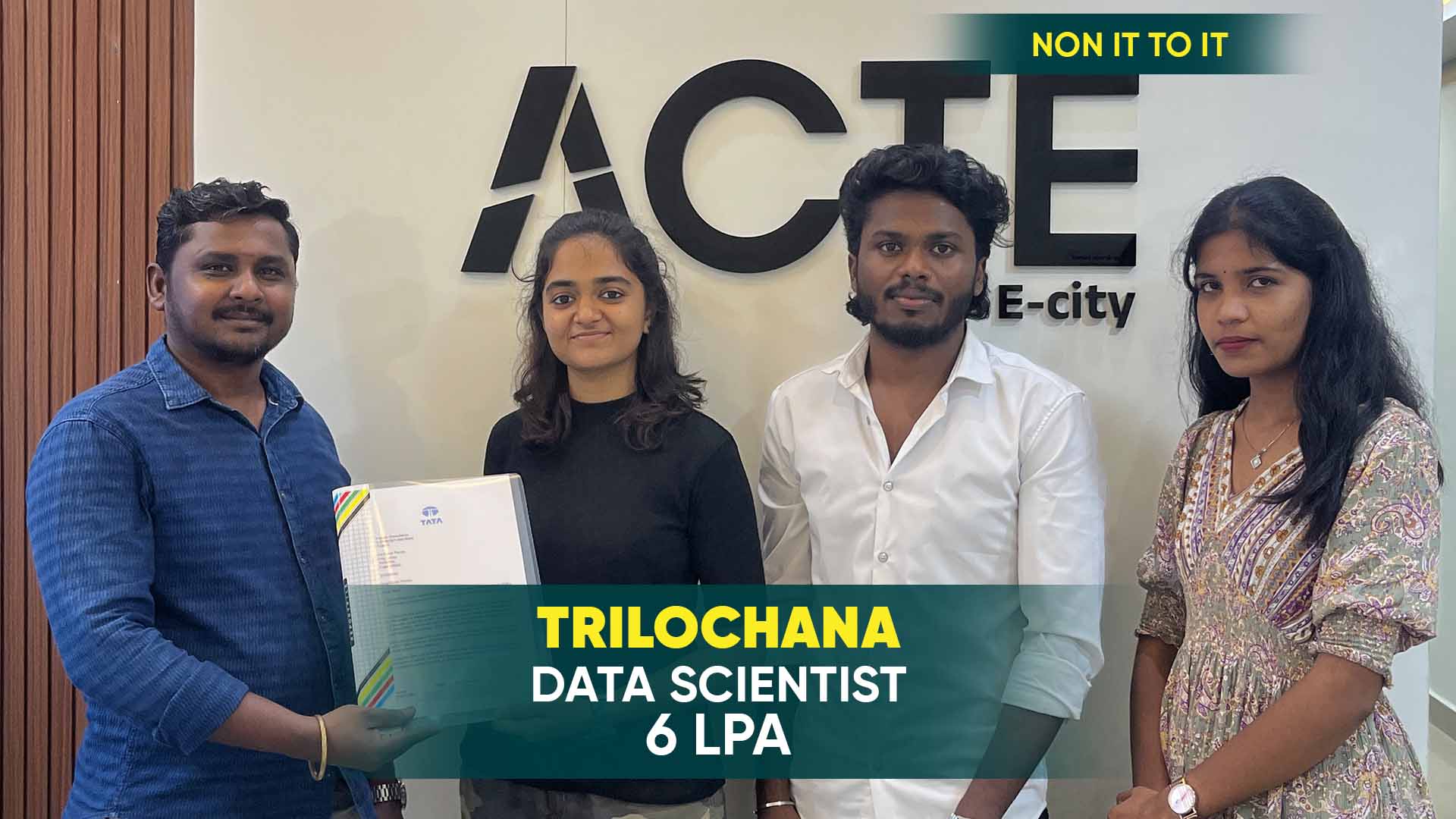

550+ Students Placed Every Month Be The Next!

Our Hiring Partners

Curriculum Designed By Experts

Expertly designed curriculum for future-ready professionals.

Industry Oriented Curriculum

An exhaustive curriculum designed by our industry experts which will help you to get placed in your dream IT company

-

30+ Case Studies & Projects

-

9+ Engaging Projects

-

10+ Years Of Experience

GST Training Projects

Become a GST Expert With Practical and Engaging Projects.

- Practice essential Tools

- Designed by Industry experts

- Get Real-world Experience

GST Registration Process

Learn to complete GST registration for a business, understanding the legal requirements and documentation. Gain hands-on experience in navigating government portals and compliance forms.

Invoice Generation Under GST

Create sample GST-compliant invoices to practice correct tax calculations and invoice formats. Understand different invoice types and tax rate applications in real scenarios.

Basic GST Return Filing

File GSTR-1 and GSTR-3B returns using sample data to familiarize with the filing process and deadlines. Develop accuracy in return submissions to avoid common filing errors.

Input Tax Credit (ITC) Reconciliation

Work on matching purchase invoices with input tax credit claims to ensure accurate accounting. Learn to identify discrepancies and rectify ITC claims effectively.

GST Audit Preparation

Simulate preparation for a GST audit, organizing records and generating required reports for compliance checks. Build skills in document management and audit trail maintenance.

Reverse Charge Mechanism Application

Practice applying reverse charge provisions in different purchase scenarios to understand compliance nuances. Enhance your understanding of liabilities under reverse charge rules.

GST Compliance for E-Commerce Operators

Manage GST accounting and return filing for an e-commerce platform involving multiple states. Handle complex multi-state tax challenges and vendor management.

Cross-Border Supply and IGST Calculation

Handle complex transactions involving inter-state and international supplies with correct tax application. Master the nuances of integrated tax and customs duty implications.

GST Litigation Case Study

Analyze real case studies on GST disputes, preparing legal arguments and documentation for resolution. Gain insight into dispute resolution and GST tribunal procedures.

Career Support

Placement Assistance

Exclusive access to ACTE Job portal

Mock Interview Preparation

1 on 1 Career Mentoring Sessions

Career Oriented Sessions

Resume & LinkedIn Profile Building

Key Features

Practical Training

Global Certifications

Flexible Timing

Trainer Support

Study Material

Placement Support

Mock Interviews

Resume Building

Upcoming Batches

What's included

Free Aptitude and

Technical Skills Training

Free Aptitude and

Technical Skills Training

- Learn basic maths and logical thinking to solve problems easily.

- Understand simple coding and technical concepts step by step.

- Get ready for exams and interviews with regular practice.

Hands-On Projects

Hands-On Projects

- Work on real-time projects to apply what you learn.

- Build mini apps and tools daily to enhance your coding skills.

- Gain practical experience just like in real jobs.

AI Powered Self

Interview Practice Portal

AI Powered Self

Interview Practice Portal

- Practice interview questions with instant AI feedback.

- Improve your answers by speaking and reviewing them.

- Build confidence with real-time mock interview sessions.

Interview Preparation

For Freshers

Interview Preparation

For Freshers

- Practice company-based interview questions.

- Take online assessment tests to crack interviews

- Practice confidently with real-world interview and project-based questions.

LMS Online Learning

Platform

LMS Online Learning

Platform

- Explore expert trainer videos and documents to boost your learning.

- Study anytime with on-demand videos and detailed documents.

- Quickly find topics with organized learning materials.

- Learning strategies that are appropriate and tailored to your company's requirements.

- Live projects guided by instructors are a characteristic of the virtual learning environment.

- The curriculum includes of full-day lectures, practical exercises, and case studies.

GST Training Overview

GST Training in Chennai: Learner’s Potential Career Paths

GST training in Chennai paves the way for diverse career opportunities in taxation and finance. Learners can become GST consultants, tax analysts, compliance officers, audit executives, or finance managers. With businesses increasingly focusing on tax compliance, skilled GST professionals are in high demand across sectors such as manufacturing, retail, e-commerce, and accounting firms. This training equips candidates with the knowledge to navigate GST laws efficiently, opening doors to rewarding roles in both private and government organizations.

What Are the Requirements for a GST Course in Chennai?

- Educational Qualification: Minimum 10+2 or graduation in commerce/finance preferred.

- Basic Accounting Knowledge: Understanding of financial statements and bookkeeping.

- Familiarity with Taxation: Basic concepts of indirect taxes and finance.

- Computer Literacy: Ability to work with accounting software and GST portals.

- Attention to Detail: Critical for accurate tax calculations and filing.

Reasons to Consider Enrolling in GST Placement Programs in Chennai

Enrolling in a GST placement program in Chennai offers practical experience and industry exposure crucial for job readiness. These programs provide hands-on training with live projects and GST return filing simulations, which build confidence and competence. Additionally, students benefit from expert mentorship, resume building, and interview preparation, enhancing their employability. Chennai’s growing industrial base and tax consultancy firms offer ample placement opportunities for trained GST professionals.

Techniques and Trends in GST Training in Chennai

- Digital GST Filing: Mastering online filing portals and e-invoicing

- Automated Tax Compliance Tools: Use of software to simplify GST calculations

- Input Tax Credit Management: Accurate reconciliation techniques

- GST Audit and Assessment: Preparing for audits with best practices

- GST in E-commerce: Handling multi-state and interstate supply complexities

The Most Recent GST Course Tools

Modern GST training in Chennai incorporates the latest software and tools such as ClearTax, Tally ERP, and GSTN portal applications. These tools help learners practice real-time filing, generate reports, and manage tax compliance seamlessly. By integrating technology with GST laws, the course prepares students for efficient tax management and smooth business operations in today’s digital economy.

Career Opportunities After GST Training

GST Consultant

A GST Consultant is responsible for helping businesses comply with GST regulations. They assist in filing GST returns, ensuring tax compliance, and advising on input tax credit claims.Their role includes auditing financial records.

Accounts Executive (GST)

Handles day-to-day accounting tasks with a focus on GST transactions. This includes maintaining records of sales and purchases, preparing invoices, and assisting in the preparation and filing of GST returns. They monitor and update the GST compliance status,

GST Analyst

A GST Analyst plays a key role in analyzing tax data, transaction records, and financial reports to ensure GST compliance. They work closely with finance and accounts teams to reconcile tax data, identify discrepancies, and generate reports.

Indirect Tax Manager

Oversees the entire indirect tax function of an organization, including GST, service tax, and VAT. They develop tax strategies, ensure compliance across departments, and manage communication with tax authorities,They also monitor and assess the impact of tax changes.

GST Auditor

A GST Auditor is responsible for conducting tax audits and financial inspections to ensure that businesses are filing their GST returns accurately and following compliance norms.They review financial statements, tax filings, and ITC (Input Tax Credit) claims to detect any errors or discrepancies.

GST Trainer / Faculty

A GST Trainer educates professionals, students, and businesses about GST laws, tax filing procedures, and compliance requirements. They conduct workshops, online training sessions, and certification programs to teach tax professionals about the latest updates in GST regulations.

Skill to Master

GST Registration & Compliance

GST Return Filing

Input Tax Credit (ITC) Management

GST Invoicing & Billing

Tax Calculation & Payment

E-Way Bill System

GST Audit & Assessment

GST Refund Process

Reverse Charge Mechanism

TDS & TCS Under GST

GST Software & Tools

Legal & Regulatory Framework

Tools to Master

GSTN Portal

Tally Prime

ClearTax GST

Zoho Books

Marg GST Software

QuickBooks GST

Saral GST

Busy Accounting Software

Gen GST Software

GST Hero

Vyapar GST Software

E-Way Bill Portal

Learn from certified professionals who are currently working.

Training by

Ravi, having 5 years of experience

Specialized in: GST Registration, E-Way Billing, Input Tax Credit, and Accounting Software Integration.

Note: Ravi is renowned for his expertise in simplifying complex GST regulations and helping businesses achieve full compliance. He has successfully trained numerous professionals in practical GST applications and effective tax planning strategies.

Premium Training at Best Price

Affordable, Quality Training for Freshers to Launch IT Careers & Land Top Placements.

What Makes ACTE Training Different?

Feature

ACTE Technologies

Other Institutes

Affordable Fees

Competitive Pricing With Flexible Payment Options.

Higher Fees With Limited Payment Options.

Industry Experts

Well Experienced Trainer From a Relevant Field With Practical Training

Theoretical Class With Limited Practical

Updated Syllabus

Updated and Industry-relevant Course Curriculum With Hands-on Learning.

Outdated Curriculum With Limited Practical Training.

Hands-on projects

Real-world Projects With Live Case Studies and Collaboration With Companies.

Basic Projects With Limited Real-world Application.

Certification

Industry-recognized Certifications With Global Validity.

Basic Certifications With Limited Recognition.

Placement Support

Strong Placement Support With Tie-ups With Top Companies and Mock Interviews.

Basic Placement Support

Industry Partnerships

Strong Ties With Top Tech Companies for Internships and Placements

No Partnerships, Limited Opportunities

Batch Size

Small Batch Sizes for Personalized Attention.

Large Batch Sizes With Limited Individual Focus.

LMS Features

Lifetime Access Course video Materials in LMS, Online Interview Practice, upload resumes in Placement Portal.

No LMS Features or Perks.

Training Support

Dedicated Mentors, 24/7 Doubt Resolution, and Personalized Guidance.

Limited Mentor Support and No After-hours Assistance.

We are proud to have participated in more than 40,000 career transfers globally.

GSTCertification

Pursuing GST training in Chennai equips you with the essential knowledge and practical skills to navigate India’s Goods and Services Tax system effectively. With GST being a cornerstone of the country’s tax structure, professionals skilled in GST compliance and filing are in high demand.

>p

Yes, many GST certification exams offer online proctored options. You can take the exam remotely from your home or office. Online exams ensure convenience and flexible scheduling.

While real-world experience enhances understanding and practical application, it is not strictly required to earn GST certification. Many training programs, including hands-on projects and simulations, prepare candidates adequately.

Yes, ACTE’s GST training course offers comprehensive curriculum coverage with practical sessions led by industry experts. The program provides hands-on learning, real-time projects, and placement support, making it a valuable investment

Frequently Asked Questions

- ACTE’s GST trainers are industry experts with extensive experience in taxation, compliance, and accounting.

- They typically hold professional certifications like CA or CMA or have years of practical experience handling GST implementation and audits.

- Yes, ACTE provides placement support including interview preparation, resume building, and connections with top companies looking for GST professionals to help you secure relevant job opportunities.

- The GST certification offered by ACTE is well-recognized by businesses, tax firms, and financial institutions, enhancing your credibility and employability in the taxation and compliance domain.

- Yes, the course includes practical workshops such as GST return filing simulations, invoice preparation, audit procedures, and hands-on use of GST software to ensure you gain real-world experience.

)