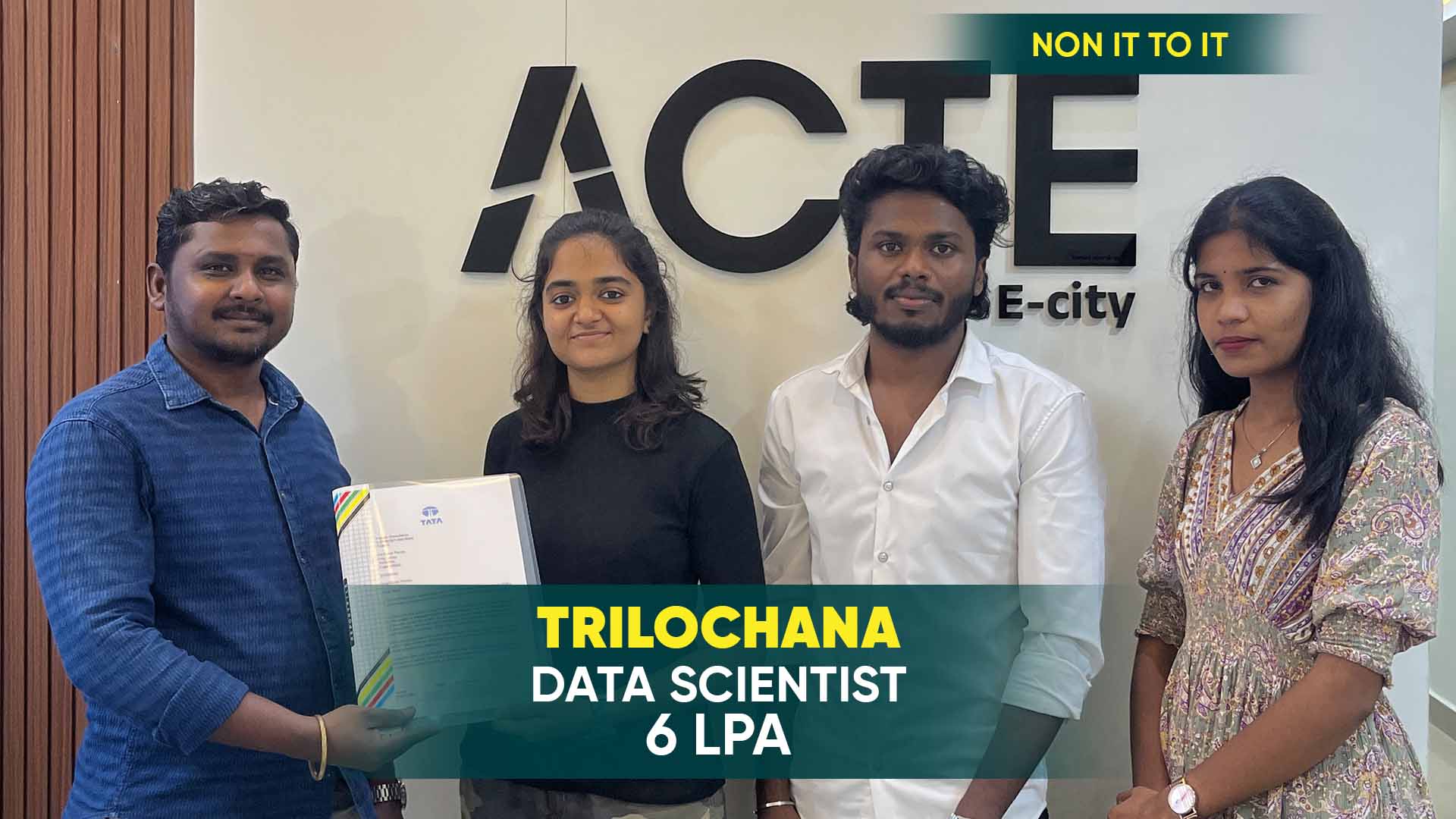

550+ Students Placed Every Month Be The Next!

Our Hiring Partners

Curriculam Designed By Experts

Expertly designed curriculum for future-ready professionals.

Industry Oriented Curriculum

An exhaustive curriculum designed by our industry experts which will help you to get placed in your dream IT company

-

30+ Case Studies & Projects

-

9+ Engaging Projects

-

10+ Years Of Experience

GST Training Projects

Become a GST Expert With Practical and Engaging Projects.

- Practice essential Tools

- Designed by Industry experts

- Get Real-world Experience

GST Registration Simulation

Learners practice registering a business under GST using mock documents and online portals. This helps beginners understand registration steps, document requirements, and portal navigation.

Basic Invoice Preparation

Students create GST-compliant invoices for goods and services, applying correct tax rates and calculating GST amounts. This project strengthens foundational knowledge of GST calculations.

Input Tax Credit (ITC) Exercises

Learners calculate ITC for simple purchase and sales transactions, learning how to claim eligible credits and understand blocked credits.

GST Returns Filing Simulation (GSTR-3B)

Learners file complete GSTR-3B returns with multiple invoices, ITC adjustments, and tax calculations. This project helps in practical return filing and reconciliation.

E-Way Bill Generation Project

Students generate and cancel E-Way Bills for various transportation scenarios, learning compliance requirements and operational procedures.

Sector-Specific GST Analysis

Learners analyze GST applicability in sectors like manufacturing, services, and e-commerce, preparing reports and identifying compliance challenges.

Full GST Compliance Project

Learners manage end-to-end GST compliance for a mock company, including registration, invoicing, returns filing, ITC reconciliation, and payments.

GST Audit Simulation

Students participate in a mock GST audit, reviewing records, identifying discrepancies, and suggesting corrections for compliance.

Refund Claims and Adjustments Project

Learners prepare and file GST refund claims for exporters, zero-rated supplies, or excess tax payments, understanding complex procedures.

Career Support

Placement Assistance

Exclusive access to ACTE Job portal

Mock Interview Preparation

1 on 1 Career Mentoring Sessions

Career Oriented Sessions

Resume & LinkedIn Profile Building

Key Features

Practical Training

Global Certifications

Flexible Timing

Trainer Support

Study Material

Placement Support

Mock Interviews

Resume Building

Upcoming Batches

What's included

Free Aptitude and

Technical Skills Training

Free Aptitude and

Technical Skills Training

- Learn basic maths and logical thinking to solve problems easily.

- Understand simple coding and technical concepts step by step.

- Get ready for exams and interviews with regular practice.

Hands-On Projects

Hands-On Projects

- Work on real-time projects to apply what you learn.

- Build mini apps and tools daily to enhance your coding skills.

- Gain practical experience just like in real jobs.

AI Powered Self

Interview Practice Portal

AI Powered Self

Interview Practice Portal

- Practice interview questions with instant AI feedback.

- Improve your answers by speaking and reviewing them.

- Build confidence with real-time mock interview sessions.

Interview Preparation

For Freshers

Interview Preparation

For Freshers

- Practice company-based interview questions.

- Take online assessment tests to crack interviews

- Practice confidently with real-world interview and project-based questions.

LMS Online Learning

Platform

LMS Online Learning

Platform

- Explore expert trainer videos and documents to boost your learning.

- Study anytime with on-demand videos and detailed documents.

- Quickly find topics with organized learning materials.

- Learning strategies that are appropriate and tailored to your company's requirements.

- Live projects guided by instructors are a characteristic of the virtual learning environment.

- The curriculum includes of full-day lectures, practical exercises, and case studies.

GST Training Overview

Uses of GST

Goods and Services Tax (GST) is a comprehensive indirect tax that has transformed the Indian taxation system by unifying multiple state and central taxes into a single framework. It simplifies the tax structure, reduces the cascading effect of taxes, and ensures transparency in business transactions. Businesses benefit from easier compliance, streamlined accounting, and enhanced input tax credit management. GST promotes uniformity across states, facilitating interstate trade and reducing logistical complexities. For individuals and professionals, GST knowledge enhances employability in finance, accounting, taxation, and consultancy roles. Understanding GST is critical for accurate tax planning, audit preparation, and ensuring regulatory compliance in any commercial operation.

Industry Projects Related to GST

- GST Return Filing Simulation : Students work on projects that involve filing GSTR-1, GSTR-3B, and GSTR-9 returns for different business scenarios. This hands-on approach familiarizes learners with real-life invoicing, tax calculations, and compliance timelines, mirroring industry practices.

- Input Tax Credit Reconciliation Projects : Projects include calculating ITC, adjusting blocked credits, and reconciling purchase and sales records. These exercises prepare learners for managing ITC in actual business operations, ensuring accuracy and regulatory compliance.

- E-Way Bill Generation Exercises : Learners create and cancel E-Way Bills for various transportation cases. These projects give practical knowledge of logistics compliance, real-time monitoring, and interstate tax procedures in industry settings.

- GST Audit and Compliance Case Studies : Students analyze audit reports, identify discrepancies, and suggest corrections. This project develops problem-solving skills and prepares learners for GST audits, assessment, and corporate compliance roles.

Overview of GST Training in Thiruvanmiyur

GST Training in Thiruvanmiyur offers a comprehensive curriculum covering fundamentals, practical applications, return filing, ITC management, compliance, and advanced industry-specific modules. The program is designed by experts to ensure learners gain both theoretical knowledge and hands-on skills through live projects, mock exercises, and simulations. Students are trained on the latest GST software, e-way bill systems, and digital filing platforms, ensuring readiness for real-world tasks. Personalized coaching, doubt-clearing sessions, and access to study materials and video lectures make this training suitable for beginners, finance professionals, and business owners alike. The focus is on equipping learners to handle GST operations efficiently and preparing them for certification exams.

Ways to Improve Skills During GST Training in Thiruvanmiyur

- Hands-on Projects : Engaging in practical exercises such as return filing, ITC reconciliation, and E-Way Bill generation helps learners apply theoretical concepts in realistic scenarios, reinforcing their understanding.

- Software and Tool Practice : Regular practice with GST portal software, accounting tools, and online filing systems ensures learners develop proficiency in digital platforms commonly used in businesses.

- Mock Tests and Assessments : Frequent testing, quizzes, and assessments allow learners to evaluate their knowledge, identify gaps, and build confidence in both practical and theoretical GST concepts.

- Interactive Sessions and Mentoring : Participating in discussions, doubt-clearing sessions, and mentorship programs provides guidance on complex topics, industry practices, and strategic tax planning.

Company Role Opportunities After GST Training in Thiruvanmiyur

After completing GST Training in Thiruvanmiyur, learners are equipped to take on various roles in finance, taxation, and accounting departments. Companies often hire certified GST professionals for positions such as GST Consultant, Tax Analyst, Accounts Executive, Compliance Officer, and Financial Analyst. These roles involve managing tax filings, ensuring compliance with GST regulations, reconciling input credits, and advising on tax planning strategies. Professionals with GST expertise are highly sought after in corporate finance teams, auditing firms, BPOs, and consultancy services. Completing this training not only enhances employability but also prepares learners to handle complex tax operations efficiently, contributing to organizational growth and ensuring regulatory adherence.

Career Opportunities After GST Training

GST Consultant

A GST Consultant advises businesses on GST compliance, tax planning, and regulatory updates. They assist with registration, return filing, input tax credit reconciliation, and resolving tax disputes. Consultants analyze transactions to ensure adherence to GST laws and help organizations.

Tax Analyst (GST)

A GST Tax Analyst monitors tax computations, reconciles invoices, and prepares reports for management. They analyze GST data, identify discrepancies, and support internal audits. Their role is critical for ensuring accurate tax filings and maintaining compliance with government.

Accounts Executive – GST

An Accounts Executive specializing in GST manages day-to-day accounting tasks related to GST, including invoicing, payment tracking, and returns filing. They maintain records, update ledgers, and assist in audits, ensuring smooth financial operations within organizations.

GST Compliance Officer

A GST Compliance Officer ensures that a company adheres to all GST regulations. They oversee return filing, ITC claims, E-Way Bill generation, and documentation for audits. This role is vital for avoiding penalties and maintaining regulatory compliance.

Financial Analyst – GST Focus

A Financial Analyst with GST expertise evaluates the financial impact of GST on business operations. They prepare reports, forecast tax liabilities, and provide insights for strategic decision-making. This role bridges finance management with tax compliance.

GST Trainer / Instructor

A GST Trainer delivers professional training programs to students, accountants, and professionals. They cover GST laws, return filing, ITC, compliance, and practical projects. Trainers also mentor learners for certification exams

Skills to Master

GST Registration

Invoice Preparation

Input Tax Credit (ITC) Management

Return Filing (GSTR-1, GSTR-3B, GSTR-9)

E-Way Bill Generation

Tax Computation

Compliance Management

Audit Handling

Refund Processing

Tax Planning

Reconciliation of Accounts

Industry-Specific GST Application

Tools to Master

GST Portal

Tally ERP 9

QuickBooks

Zoho Books

ClearTax

Busy Accounting Software

SAP GST Module

MS Excel (for GST calculations)

GST Return Filing Software

IRIS GST Software

Government E-Way Bill Portal

Taxmann GST Software

Learn from certified professionals who are currently working.

Training by

Rohit, having 12 yrs of experience

Specialized in: GST Compliance, Tax Filing, Input Tax Credit Management, and Return Reconciliation.

Note: Rohit is recognized for his practical approach in training students on real-time GST applications, ensuring learners can handle complex compliance scenarios efficiently.

Premium Training at Best Price

Affordable, Quality Training for Freshers to Launch IT Careers & Land Top Placements.

What Makes ACTE Training Different?

Feature

ACTE Technologies

Other Institutes

Affordable Fees

Competitive Pricing With Flexible Payment Options.

Higher Fees With Limited Payment Options.

Industry Experts

Well Experienced Trainer From a Relevant Field With Practical Training

Theoretical Class With Limited Practical

Updated Syllabus

Updated and Industry-relevant Course Curriculum With Hands-on Learning.

Outdated Curriculum With Limited Practical Training.

Hands-on projects

Real-world Projects With Live Case Studies and Collaboration With Companies.

Basic Projects With Limited Real-world Application.

Certification

Industry-recognized Certifications With Global Validity.

Basic Certifications With Limited Recognition.

Placement Support

Strong Placement Support With Tie-ups With Top Companies and Mock Interviews.

Basic Placement Support

Industry Partnerships

Strong Ties With Top Tech Companies for Internships and Placements

No Partnerships, Limited Opportunities

Batch Size

Small Batch Sizes for Personalized Attention.

Large Batch Sizes With Limited Individual Focus.

LMS Features

Lifetime Access Course video Materials in LMS, Online Interview Practice, upload resumes in Placement Portal.

No LMS Features or Perks.

Training Support

Dedicated Mentors, 24/7 Doubt Resolution, and Personalized Guidance.

Limited Mentor Support and No After-hours Assistance.

We are proud to have participated in more than 40,000 career transfers globally.

GSTCertification

Pursuing a GST Training certification validates your knowledge of Goods and Services Tax laws, compliance procedures, and practical applications. It enhances your credibility in accounting, finance, and taxation roles, making you more employable in corporates, BPOs, audit firms, and consultancy services.

However, familiarity with basic accounting principles, invoicing, and business transactions is beneficial. Completing a structured GST training program covering registration, tax rates, ITC, return filing, E-Way Bills, and compliance ensures readiness.

Real-world experience enhances understanding but is not required; the certification primarily tests knowledge of GST principles, procedures, and applications.

Yes, ACTE GST Training Certification is highly valuable for anyone aiming to build a career in taxation, accounting, or finance. The program provides structured learning, expert guidance, hands-on projects, and exposure to real-time GST operations.

Frequently Asked Questions

- Yes, ACTE offers a free demo session to help you understand the GST course structure and teaching approach.The demo session allows you to interact with the trainer and clarify your learning expectations before enrollment.

- ACTE instructors are experienced GST professionals with strong industry exposure in taxation, accounting, auditing, and compliance. They have hands-on experience in GST return filing, ITC reconciliation, audits, and real-time business scenarios.

- ACTE provides dedicated placement assistance to support learners in securing roles related to GST and accounting. This includes resume preparation, interview guidance, mock interviews, and job referrals to companies looking for GST-trained professionals.

- After successful completion of the course, learners receive an ACTE GST Training Certification. This certification validates your knowledge of GST laws, compliance procedures, return filing, and practical applications.

- Yes, students work on live and practical GST projects as part of the course.

- These projects include GST registration, invoice preparation, return filing , ITC reconciliation, and E-Way Bill generation.

)